Pursuing new opportunities for growth

To fuel further growth, we are focusing on opportunities in adjacent business where Ageas has the capability to participate and create impact. Home, Mobility and Life & Savings are our local priorities. Specifically at Group level, the following four areas will fuel our growth.

Health

We will scale up innovation and transfer knowledge and expertise to launch Health ecosystems where we see opportunities to replicate our success in Portugal and Belgium. Expanding into these adjacent businesses might include Health care coordination for chronic diseases, wellbeing and prevention services, care pathways and digitally enabled care delivery. We are not necessarily looking to be a fully-fledged Health Insurer, but we do want to participate in the Health ecosystem based on a proven business model.

Protection

We also plan to expand in the Protection space, especially in Asia which is growing at an accelerated rate with a wide range of innovative products. Protection is not new to us, we see a lot of opportunities in non-reimbursement covers in the personal integrity protection space (e.g. fixed indemnity such as mortality, critical illness, personal accidents…).

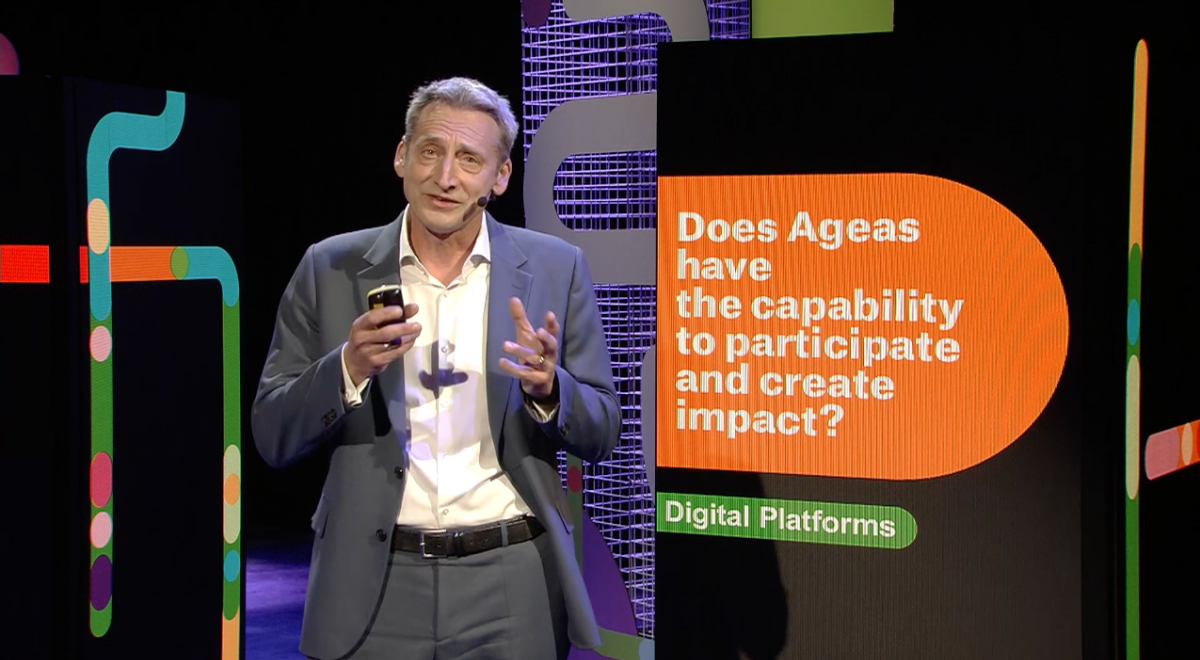

Digital platforms

We have a strong belief going forward in bancassurance, brokers and agents as the current winners. As well, we recognise that new roads to connect with customers are being developed, with a demand for new types of products and covers. And while we will continue to invest more in our physical distribution partners, including bancassurance and the development of strong broker and agency networks, we cannot ignore the new players reaching out to our customers. We have taken the view that we want to participate in this cross market and in cross sector development, meaning that we will look to invest in new partnerships with future winners that allow us to leverage the strengths of Digital platforms and Ecosystems.

Reinsurance

And as we look to other opportunities for growth as a Group, we will explore a deeper engagement in our Reinsurance activity, building on the partnership with Taiping Re. In Reinsurance, Ageas has grown from a small satellite activity delivering business and capital synergies to protect the Core, to a more fully-fledged external reinsurer in Asia. We believe there is potential to further build out our Reinsurance activities and support the new Impact24 growth engines cross-border with all the benefit that reinsurance expertise could bring to the entire Group.

An expert-view on growth engines in the Group

> Starring: Filip Coremans (Platforms and Protection), Antonio Cano (Health), Jan Van Rethy, Joachim Racz & Petra Vynckier (Reinsurance)